Hello,

Philanthropist.

Unlock your inner philanthropist by joining the world’s most modern foundation.

Unlock your inner philanthropist by joining the world’s most modern foundation.

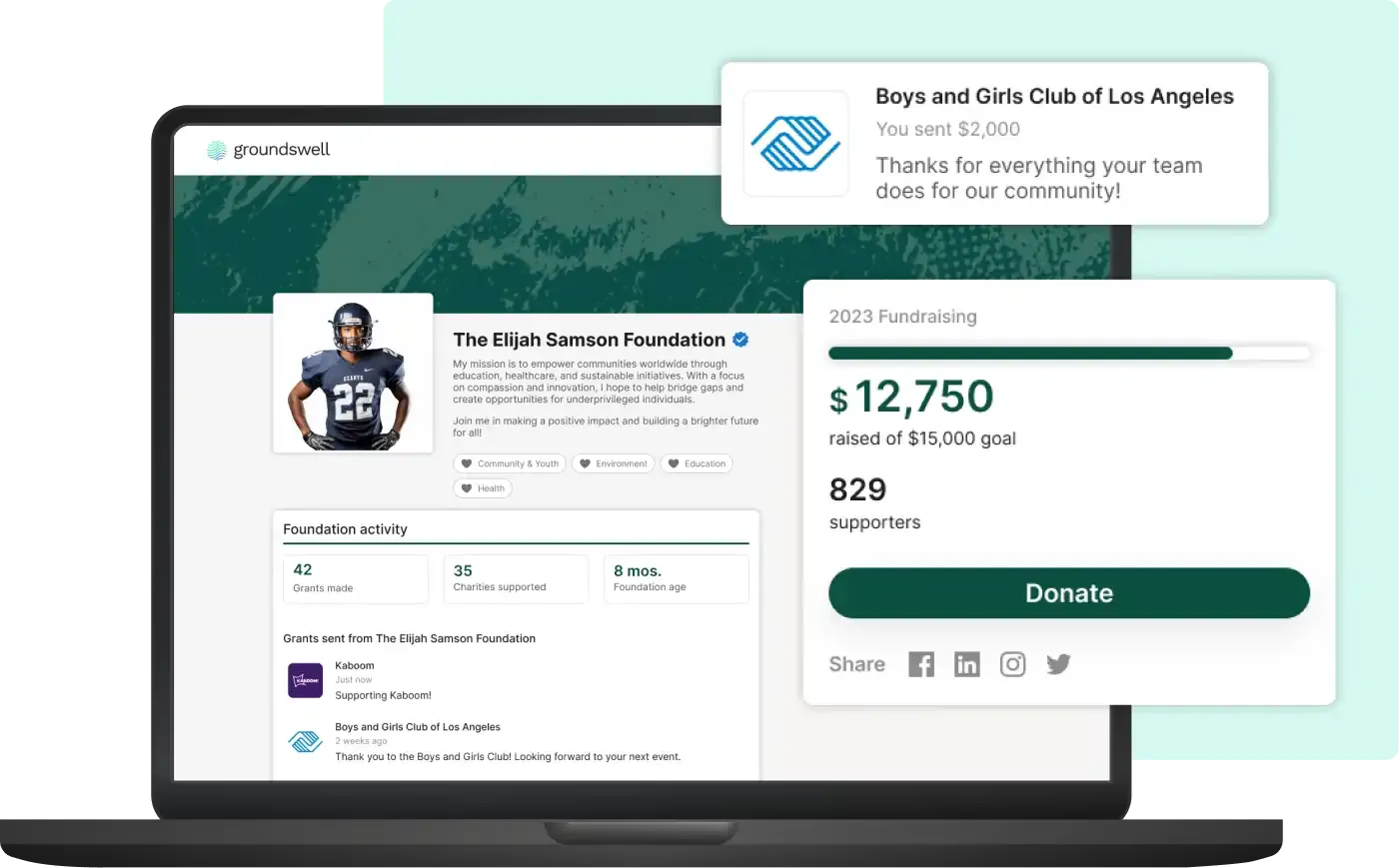

Share your impact

Each foundation comes with a public profile highlighting your values and impact.

Support charities you love

Donate to over 1.5 million IRS-approved charities

Raise funds

Anyone can contribute directly to your foundation from your public profile

Simplify your tax reporting

All your donations will be summarized in a single year-end tax receipt

Start your foundation in 60 seconds

FAQs

No. Creating a my.foundation page via the Groundswell app is not creating your own personal foundation, but rather a donor-advised fund held within the Groundswell Charitable Foundation, a registered 501(c)3 public charity.

You can access and manage your donor-advised fund at any time and on the go by downloading Groundswell on your iPhone and Android devices.

Groundswell is the world’s most modern donor-advised fund and the app that powers users’ my.foundation pages. Groundswell is available on iPhone and Android devices.

Any person or entity that contributes to a donor-advised fund receives an immediate tax deduction. Therefore, any funds that a user contributes to their own account is tax deductible to them, whereas any funds contributed to their account by someone else is tax-deductible to that person.

My.foundation allows users to fundraise into their personal Groundswell account, from which the user can direct the funds to any charity they want at a time of their choosing. Funds are sent to the charity in the name of the fundraising user. Each person or entity that contributes to the fundraising user’s account receives a charitable tax deduction for their respective contribution.

A Donor-Advised Fund (DAF) is a philanthropic vehicle that allows individuals, families, and organizations to make charitable contributions and manage their giving in a streamlined and strategic manner. It serves as a flexible, tax-advantaged account specifically designed for charitable giving.

When you contribute to a Donor-Advised Fund, you are making a tax-deductible donation to a sponsoring organization, such as a community foundation or in this case, the Groundswell Charitable Foundation. Once the funds are in the DAF, you can recommend how and when they are distributed to eligible charitable organizations. Although you have advisory privileges over the distribution of funds, the sponsoring organization must legally ensure that the final decisions align with the regulations governing charitable donations.

There are several advantages to using a Donor-Advised Fund:

- Tax Deductibility: Contributions to a DAF are tax-deductible in the year they are made, allowing you to potentially lower your taxable income.

- Simplicity: A DAF simplifies your charitable giving process by consolidating contributions and administrative tasks into one account.

- Strategic Giving: DAFs provide you with the flexibility to plan and organize your charitable giving over time, enabling you to have a more significant impact.

- Privacy: Donors can choose to remain anonymous when making grants from their DAF, preserving their privacy if desired.

- Investment Growth: While waiting to distribute funds to charities, the assets within a DAF can be invested, potentially increasing the amount available for charitable grants.

No, by law, Donor-Advised Funds must be used exclusively for charitable purposes. Any attempt to use DAF assets for personal benefit, such as supporting a private foundation or individual, is strictly prohibited and could result in severe penalties.